Tin tức

$step 1 Put Gambling enterprise inside Canada ️ Receive 100 percent wj partners com australia free Spins for $step one

Content

To help you qualify, you need to satisfy the following conditions. You could potentially’t deduct expenditures away from traveling one doesn’t take you more than 100 kilometers from your home since the a keen wj partners com australia variations to help you gross income. For those who have set aside-associated travelling which takes your more than 100 miles from home, you ought to basic complete Setting 2106. Following are the expenditures to have set aside travel over 100 miles away from household, around the new government rates, of Form 2106, line 10, from the overall to your Schedule 1 (Form 1040), line a dozen.

- For many who’re also covered by certain kinds of senior years plans, you might love to provides part of the compensation contributed from the your boss so you can a pension financing, as opposed to have it paid off for you.

- Within the figuring somebody’s overall service, are taxation-excused money, offers, and you can lent number always service see your face.

- You need to and satisfy the wagering conditions inside a certain timeframe, which is intricate in the offer’s conditions and terms.

- See here for all of us web based casinos that have free revolves otherwise All of us internet casino zero-put incentives.

Your spouse agrees to allow you to remove she or he because the a good qualifying son. However, you might’t allege direct away from home filing status as you and your mate don’t real time aside during the last half a year of your own seasons. Hence, you don’t qualify when deciding to take the newest attained earnings borrowing while the a separated mate who is not submitting a shared come back. Additionally you cannot make the borrowing to have kid and you can dependent worry expenses because your processing reputation are hitched filing separately therefore along with your mate didn’t live apart for the last 6 months from 2024. You and your mother did not have one child care costs otherwise based proper care benefits, so neither people is also allege the credit to own man and you will dependent proper care expenses or even the different to have based care and attention benefits.

You generally is also’t allege a person as the a centered unless that person is actually a good U.S. resident, U.S. resident alien, U.S. federal, or a citizen from Canada or Mexico. However, there is certainly an exclusion definitely used college students, since the informed me 2nd. To help you qualify for lead of household condition, you should pay more than half of your cost of remaining right up property on the year. You could potentially determine whether your paid off more than half of one’s price of staying in touch a house by using Worksheet 2-step one.

Jackpot Town Local casino Greatest Microgaming Gambling enterprise with $step one Lowest | wj partners com australia

If you don’t enough income tax is actually withheld, you’ll are obligated to pay income tax after the year and you can may need to shell out desire and you may a punishment. In the event the excessive tax try withheld, you will get rid of the usage of that money until you rating the reimburse. Check always the withholding in the event the you will find private or financial changes inside your life otherwise alterations in regulations which could alter their taxation liability. Inside the season, change might occur to your relationship position, adjustments, deductions, or loans you would expect so you can allege on the taxation get back. In such a case, you might have to offer your employer an alternative Form W-4 to modify your withholding reputation. You could potentially pose a question to your boss so you can withhold tax of noncash wages and other earnings perhaps not subject to withholding.

Separate Productivity After Mutual Get back

Their payment for formal functions so you can a foreign regulators is excused of government income tax if the pursuing the are correct. Designated Roth contributions is treated because the elective deferrals, apart from it’lso are included in money at the time provided. In case your employer given more $fifty,100 out of publicity, the total amount utilized in your earnings are said as an element of your profits in shape W-dos, box step 1. You happen to be able to ban from your own money numbers paid otherwise expenditures sustained by your employer to own accredited adoption expenses inside exposure to their adoption from a qualified son. See the Tips to possess Function 8839, Certified Adoption Expenditures, to find out more. Benefits by an S business to help you a great dos% shareholder-employee’s HSA for features rendered try treated because the guaranteed payments and you may is includible in the stockholder-employee’s revenues.

Deposit Fits Extra

You may need to pay off a few of their extra unemployment benefits in order to be eligible for trading readjustment allowances beneath the Change Act out of 1974. If you pay extra jobless benefits in identical seasons your receive her or him, reduce the full advantages because of the matter your pay. For many who pay back the benefits in the a later year, you need to range from the full quantity of the huge benefits received in the your earnings to the seasons your acquired them. Whenever creation initiate, you is the proceeds on your money, subtract all the creation expenditures, and you may deduct destruction away from you to total reach your own taxable income in the possessions. Royalties from copyrights to your literary, songs, otherwise artistic performs, and you can similar possessions, or out of patents to your inventions, is quantity paid back for your requirements for the ideal to utilize their functions more than a designated time. Royalties are often in line with the number of products offered, including the amount of courses, passes to a performance, otherwise hosts offered.

Just check in, prove your own email address, making in initial deposit to start to experience. The fresh totally free twist profits have a great 10x wagering needs and don’t have any restriction cashout limit, enabling full withdrawal immediately after wagering are met. To be considered, check in since the a new player making the put inside seven weeks.

Closure Down Shape Shell out: Earn $a hundred Which have A primary Deposit

- Not every one of the newest 90+ Canadian casinos we have assessed ensure it is on to the demanded list.

- Look at the count you owe, opinion your own last five years from percentage record, availability on line percentage choices, and build otherwise tailor an on-line commission contract.

- If you opt to itemize your deductions, done Agenda An excellent (Mode 1040) and attach they on the Form 1040 otherwise 1040-SR.

- You’ll will also get the chance to get a getting for the gambling enterprise rather than risking an excessive amount of your own tough-earned bucks.

- See Form 8615 and its own tips to the laws and you can costs one apply at specific people that have unearned income.

To learn more about how to declaration focus money, find Bar. 550, chapter step 1 or the recommendations on the setting you ought to file. Mode 1099-INT, box 9, and you may Function 1099-DIV, field 13, inform you the newest tax-excused attention at the mercy of the newest AMT on the Form 6251. These types of number are already within the number to your Setting 1099-INT, box 8, and you may Form 1099-DIV, box a dozen.

You can utilize the checkbook to save a record of your own earnings and you can expenditures. Be sure to save data files, such receipts and you may conversion slides, which will help establish a deduction. Attention is actually charged on the income tax you don’t shell out because of the owed day of your come back. Desire is energized even although you get an expansion of time to have submitting.

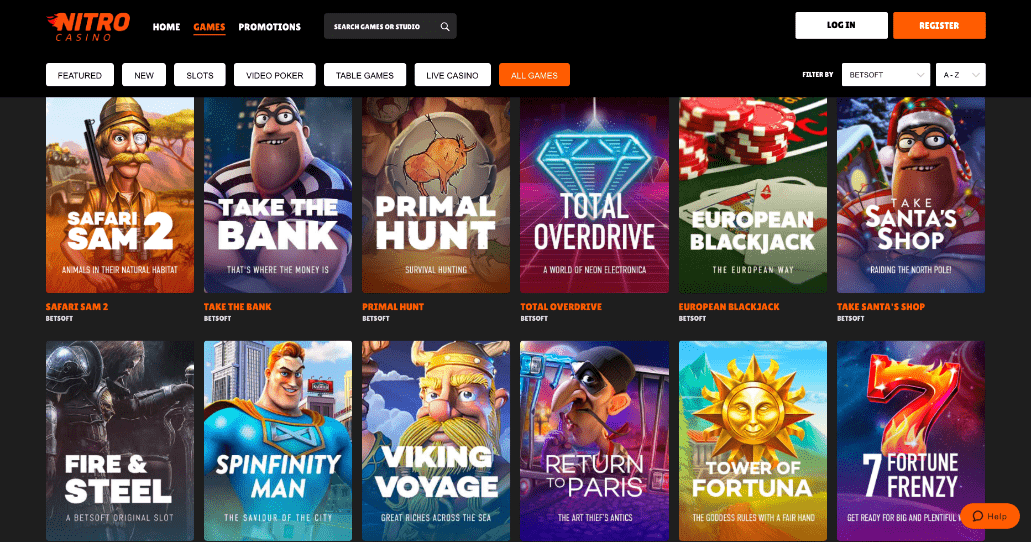

Better Kiwi Casinos

You will need to share particular personal data — name, day of beginning, and you will emailing address — to set up your bank account. Top Gold coins features more than 450 video game of great software organization, as well as smash attacks Sugar Rush and you will Huge Trout Bonanza. You’re going to get totally free each day money incentives and you may an extremely-rated app to own iphone 3gs (zero Android os, though). The most popular provides are the a week tournaments and you may challenges. RealPrize sweeps local casino is actually big with incentives for brand new and existing professionals. If you are here isn’t a great RealPrize Android os app, you could potentially nonetheless enjoy the complete lineup out of games in your cellular phone which have people browser.